Fact checking DNC 2024 Day 4 speeches of Harris, Sen. Bob Casey

CBS News is fact checking some of the statements made by speakers during the 2024 Democratic National Convention in Chicago, which took place Aug. 19-22.

On Thursday, the final night of the convention, Vice President Kamala Harris accepted her party's nomination and delivered her acceptance speech.

CBS News' Confirmed team is conducting the fact-checks, and here are several from the final night of the DNC.

Fact checking Harris' claim that Trump's tariff plan will cost families almost $4,000 per year: Partially true, needs context

Vice President Kamala Harris: "[Trump] intends to enact what in effect is a national sales tax, call it a Trump tax, that would raise prices on middle-class families by almost $4,000 a year."

Details: Harris is citing an estimate of potential costs if former President Donald Trump were to implement tariffs on imported goods. Trump has advocated for a tariff of at least 10% on most imports and a tariff of at least 60% on Chinese imports.

Estimates of the potential costs and the likely scale of the tariffs vary. An analysis by the Center for American Progress Action, a progressive policy think tank, estimated that a 20% tariff on most imports, combined with a 60% tax on Chinese goods, would amount to a tax increase of around $3,900 annually for middle-income families.

The Tax Policy Center (TPC), a nonpartisan think tank, estimated that a 10% worldwide tariff and a 60% tariff on Chinese goods would lower average after-tax incomes by about $1,800 in 2025.

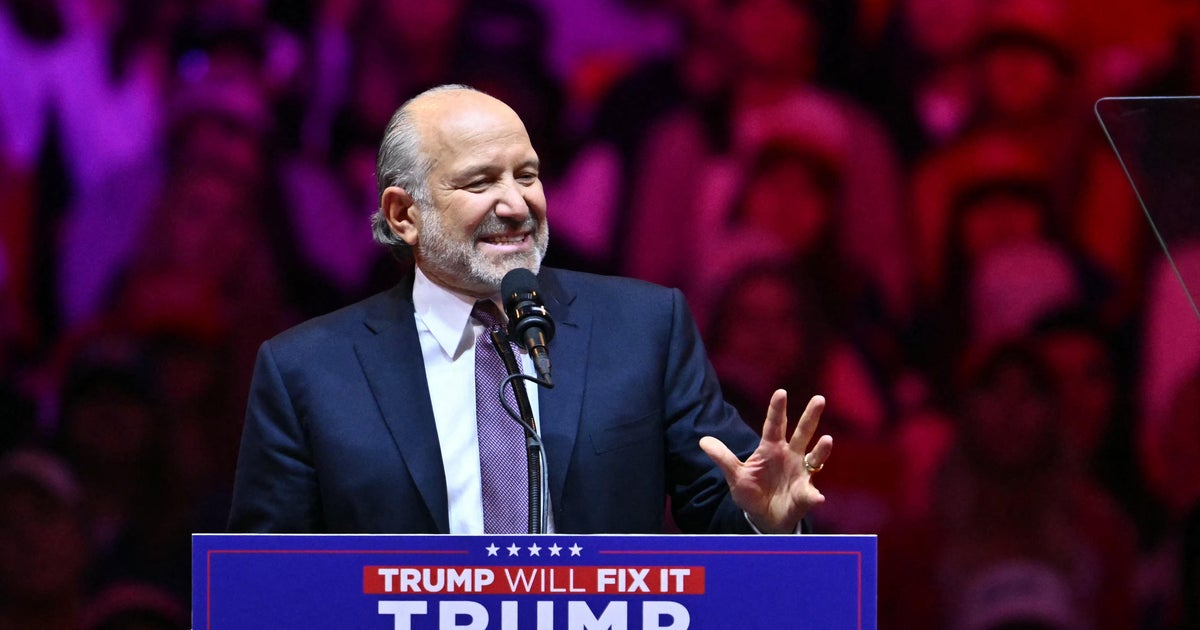

Economists told CBS News that everyday consumers would bear the brunt of higher import tariffs through increased prices on goods, effectively a tax on products made in other countries. In an interview with The New York Times, Robert Lighthizer, who served as Trump's chief trade negotiator and still advises his campaign on trade issues, suggested the burden on American households could be offset by tax cuts.

By Emma Li

Fact checking Harris' claim that Trump would give billionaires more tax breaks that would add $5 trillion to debt: Misleading

Harris: "[Trump] doesn't actually fight for the middle class. Instead, he fights for himself and his billionaire friends. And he will give them another round of tax breaks that will add up to $5 trillion to the national debt."

Details: Trump has proposed broad-based tax cuts during his presidential campaign, to high earners and other taxpayers.

Trump signed the Tax Cuts and Jobs Act in 2017 that permanently cut corporate tax rates and lowered individual tax rates for most households.

Estimates from the nonpartisan congressional Joint Committee on Taxation and the Tax Policy Center found that the majority of people would benefit from these tax cuts.

Trump has said he would extend the individual tax rate cuts before they are set to expire in 2025, a move the Congressional Budget Office estimates could cost $4.6 trillion over the next decade.

The Biden-Harris administration has proposed extending some of the Trump-era tax cuts for families earning under $400,000 annually.

Trump has also called for other tax cuts, including eliminating taxes on tips, a policy proposal also backed by Harris.

By Laura Doan

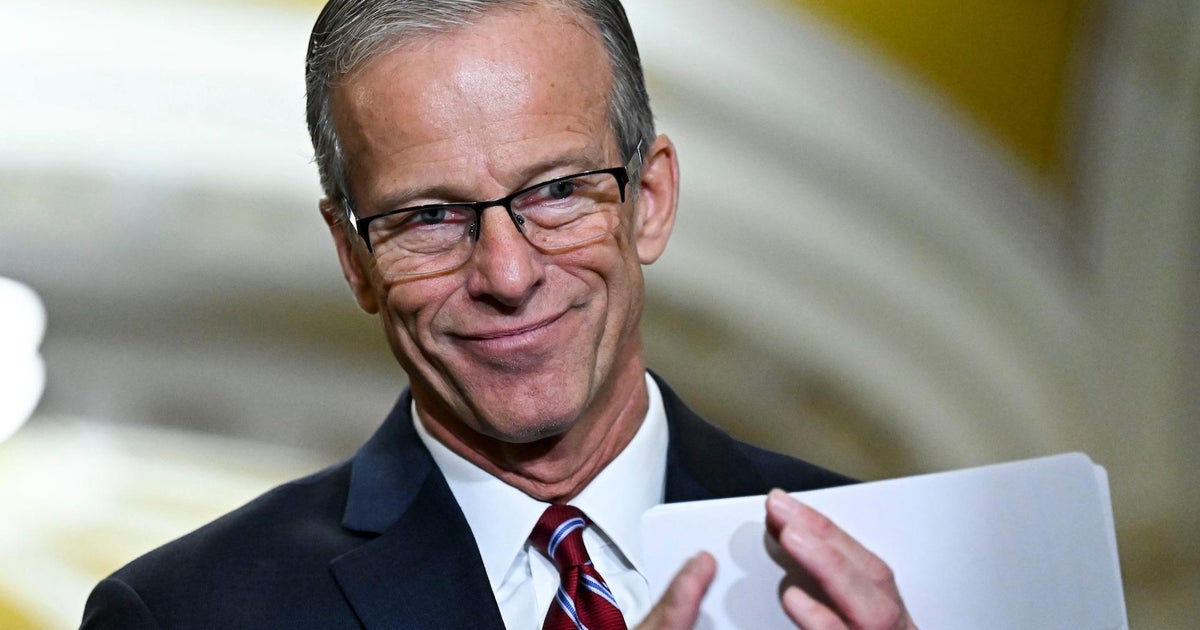

Fact check on Pennsylvania Sen. Bob Casey's claim that Democrats capped insulin costs for millions of Americans: True, but needs context

Democratic Sen. Bob Casey of Pennsylvania: "When Big Pharma jacked up the cost of insulin, we passed a bill to stop them. Now, for millions of Americans, it's capped at $35 a month."

Details: In 2022, President Biden signed the Inflation Reduction Act into law, mandating that all Medicare Part D and Part B plans cap monthly costs for covered insulin products at $35.

Previously, the Trump administration introduced a more limited voluntary program that allowed some Medicare Part D plans to cap out-of-pocket costs for certain insulin products at $35 per month. The health policy research site KFF noted less than half of all Part D programs participated in the Trump program. There were over 800,000 insulin users who had access to the $35 insulin cap under the Trump-era program in 2022, but after Mr. Biden signed the Inflation Reduction Act, far more insulin users on Medicare Part D — 3.4 million — had their insulin costs capped in 2023, according to estimates from Center for Medicare and Medicaid Services.

By Emma Li, Laura Doan and Amelia Donhauser